How to Understand and Predict Future Special Levies in Your BC Strata

For many BC strata owners, the looming possibility of a special levy can be a significant concern. Special levies - those one‐time fees imposed to cover major repairs or unforeseen expenses - can impact your long‐term budget and the value of your property. In this guide, we break down what special levies are, how depreciation reports play a key role in predicting them, and how you can interpret projected costs and cashflow scenarios to prepare for future financial obligations.

What Is a Special Levy?

A special levy is an extra fee charged to strata lot owners for expenses that fall outside your regular monthly strata fees. These levies often come into play when there isn’t enough money in the contingency reserve fund (CRF) to cover large capital projects such as roof replacements, elevator upgrades, or major exterior repairs.

Key Points:

Purpose: Fund major repairs or upgrades that aren’t budgeted for annually.

Approval: Requires a ¾ vote of the strata corporation at a general or special meeting.

Calculation: Typically based on each unit’s entitlement - meaning larger units contribute more.

The Role of Depreciation Reports

A depreciation report is a mandatory planning tool required for BC strata corporations (with five or more units) under the Strata Property Act. It provides:

A Physical Inventory: A detailed list of common property assets.

Asset Condition and Lifespan: Evaluations of the current state and anticipated service life of each component.

Financial Forecasting: A projection of repair, maintenance, and replacement costs over a 30-year period.

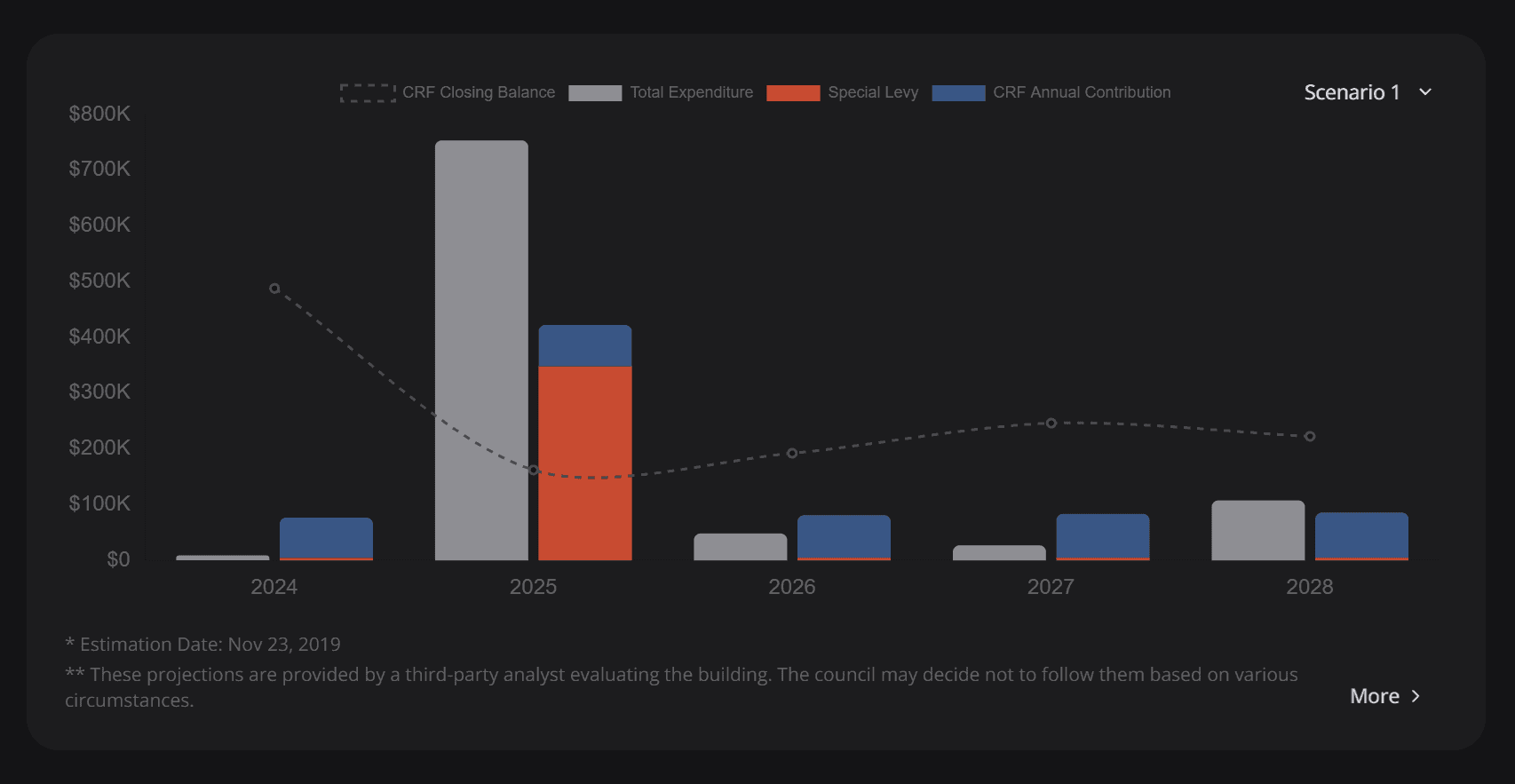

Funding Models: At least three cashflow scenarios to help determine how best to finance these future costs.

In short, the report outlines when major expenses are likely to occur and what funding strategies (e.g., drawing from the CRF, imposing special levies, or increasing strata fees) could be used to manage these expenses.

For an in-depth discussion on depreciation reports and the updated BC regulations, click here to read our full post.

Interpreting Projected Costs and Cashflow Scenarios

The financial forecasting section of a depreciation report is crucial for predicting future special levies. Here’s what you need to know:

1. Funding Models Explained

Depreciation reports typically offer three funding scenarios:

Status Quo: Assumes no changes in your current funding model. If contributions remain the same, the CRF might deplete when major repairs are due - potentially triggering a special levy.

Incremental Increase: Suggests a gradual increase in CRF contributions to better cover future costs. This can reduce the need for sudden, large special levies.

Progressive Allocation: Projects aggressive contributions in anticipation of significant repair projects, possibly offset by periods where contributions can be lower. This model smooths out costs over time but may require higher monthly fees temporarily.

2. How to Read the Numbers

When reviewing the report:

Compare CRF Balance to Future Requirements: A low reserve compared to projected costs may indicate a high risk of special levies.

Review the Assumptions: Check the estimated life spans and replacement costs. Understand that these figures are based on averages and may differ from actual costs.

Evaluate the Funding Model That Fits Your Strata: Determine whether your corporation is following a status quo, incremental, or progressive approach. Each scenario impacts how and when special levies might be imposed.

3. Practical Steps for Strata Owners

Examine Key Documents: Start with the depreciation report, Form B Information Certificate, and strata meeting minutes to gauge financial health and upcoming expenses.

Ask Questions: Inquire about recent changes in the CRF contributions and any planned capital projects.

Budget Accordingly: Use the projections to create a financial cushion or negotiate with the seller if you’re buying a unit.

How Our Strata Document Review Can Help

Predicting special levies accurately isn’t easy, and every strata is unique. Our comprehensive strata document review service is designed to help you:

Analyze Depreciation Reports: We highlight projected costs and key cashflow scenarios so you can understand your strata’s financial outlook.

Interpret Special Levy Risks: We guide you through reviewing CRF balances, meeting minutes, and other financial documents.

Make Informed Decisions: Armed with clear insights, you can negotiate purchase terms or prepare financially for future expenses.

By using our service, you’re not only ensuring compliance with BC regulations but also protecting your investment from unexpected financial shocks.

Explore our sample condo and strata document review report to discover how we highlight the potential and concerns of properties, aiding both real estate professionals and buyers.