What to Look for When Reviewing Condo Documents in Alberta

Buying a condo is a significant investment, and in Alberta, where cities like Calgary and Edmonton offer diverse condo options, reviewing condo documents is essential. These documents hold the key to understanding a building’s financial health, management practices, and potential challenges. Here’s your guide to spotting the most important red flags and protecting your investment.

Why Reviewing Condo Documents Matters

Condo documents aren’t just paperwork - they’re your window into the building’s current condition and future potential. They reveal:

Financial stability.

How well the building is managed.

Upcoming repair or maintenance costs.

Skipping this step can leave you with unexpected costs, restrictive bylaws, or ongoing disputes that could affect your quality of life.

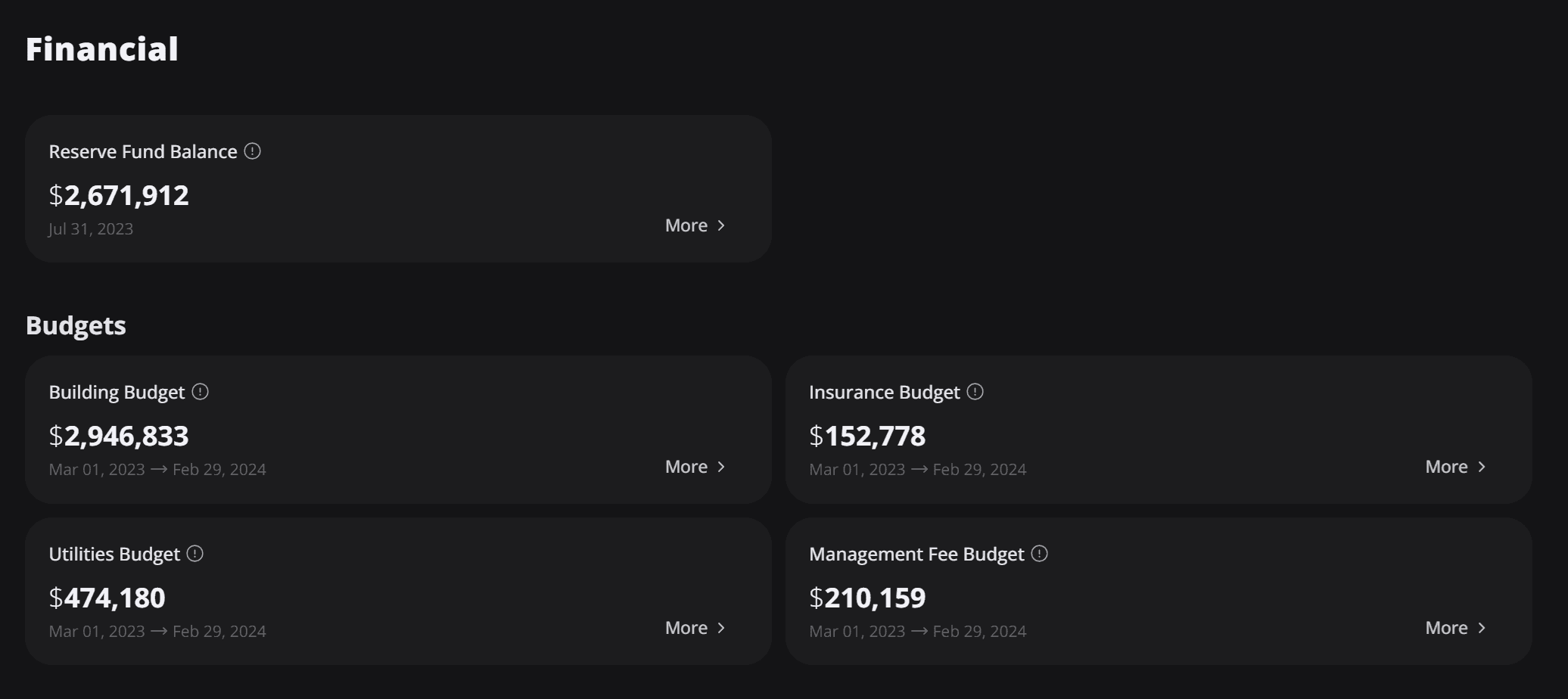

Financial Health: Fees, Assessments, and Reserves

Condo Fees

Condo fees cover shared building expenses like maintenance, insurance, and utilities. If fees are unusually high or have been increasing frequently, it could indicate poor financial planning or costly repairs.

Special Assessments

Special assessments are additional fees charged when the condo’s reserve fund cannot cover unexpected repairs. If the building frequently relies on assessments, it may point to poor maintenance or inadequate budgeting.

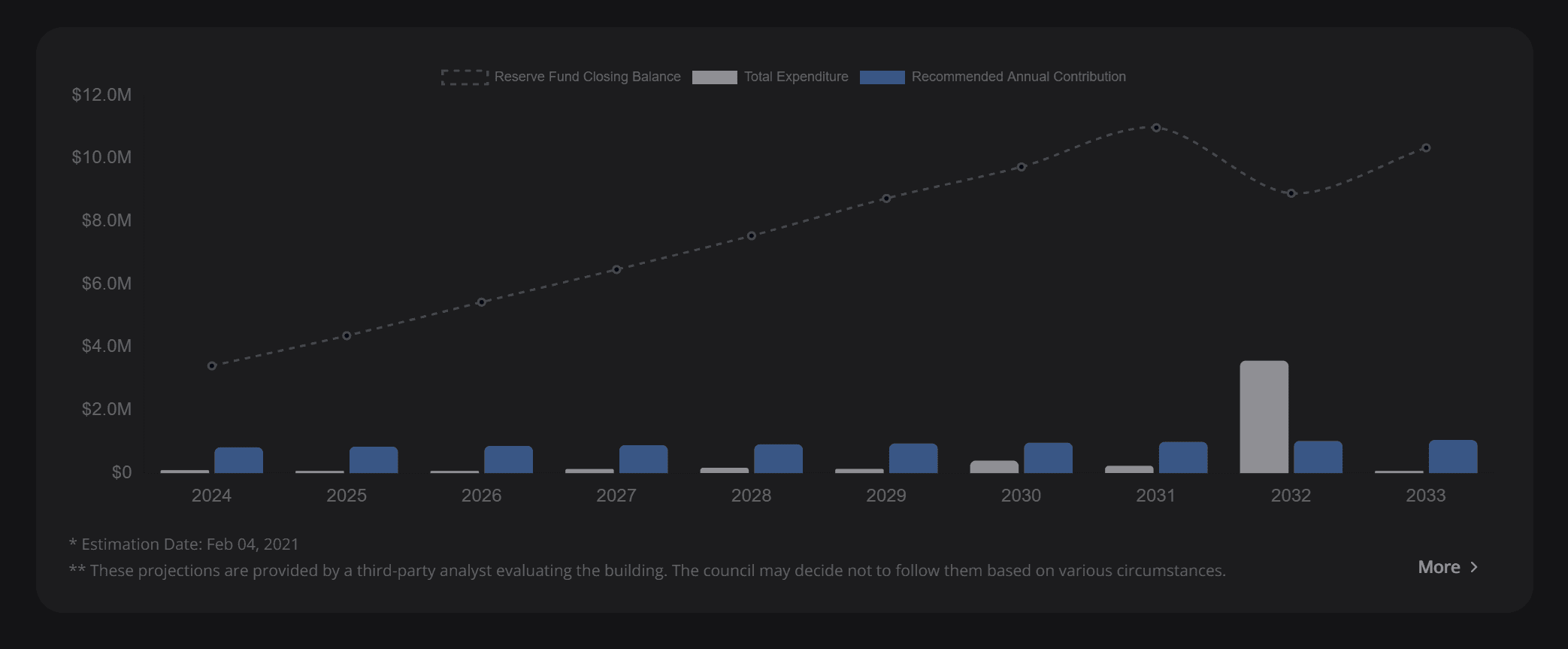

Reserve Fund Study Plan

The reserve fund is a savings account for future repairs, and the reserve fund study outlines how well-prepared the building is for major expenses.

Why It’s Important:

A healthy reserve fund indicates the building is financially stable, while an underfunded reserve could lead to unexpected costs for owners. Reviewing the reserve fund study plan also provides insights into the building’s physical health - are major systems, like the roof or plumbing, being proactively maintained, or is maintenance being deferred?

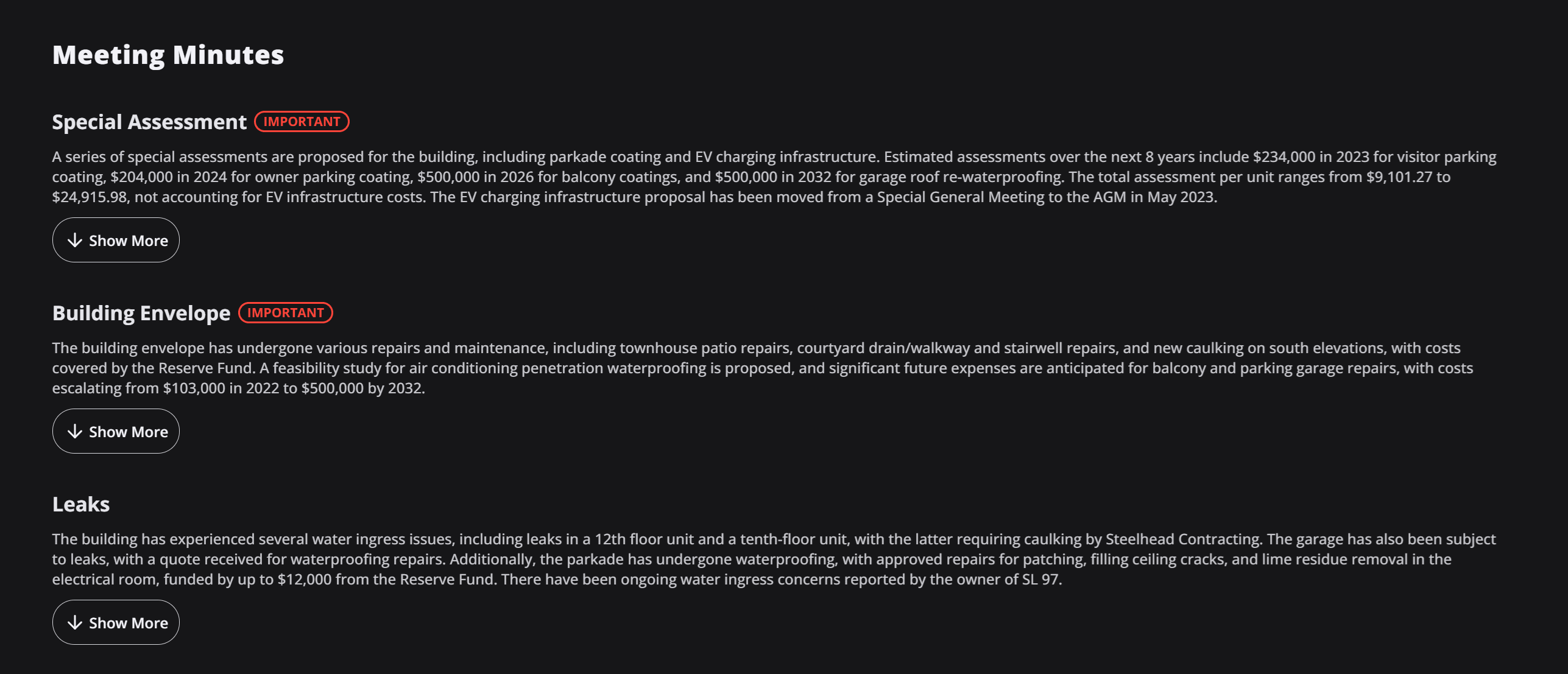

Meeting Minutes: Insights Into Management

Meeting minutes from condo board meetings offer valuable details about how the building is managed. Look for:

Repeated issues that remain unresolved, such as leaks or noise complaints.

Discussions about upcoming repairs or assessments.

The tone and frequency of disputes among owners or with contractors.

Stable and transparent management is key to a well-run condo building.

Legal and Insurance Red Flags

Legal Disputes

Check if the condo corporation is involved in ongoing legal battles. Lawsuits can drain resources and lead to higher fees or special assessments.

Insurance Coverage

Adequate insurance protects against disasters like fire or flooding. Poor coverage could leave owners financially vulnerable, especially in Alberta, where winter storms or sudden floods can occur.

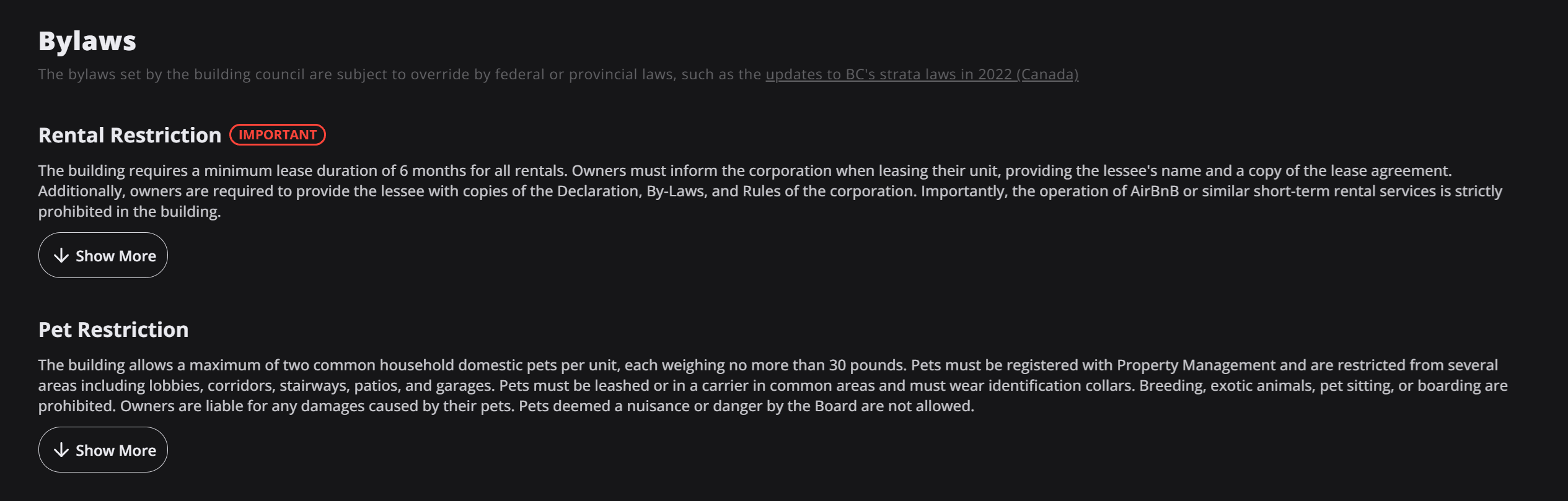

Bylaws That Match Your Lifestyle

Condo bylaws govern everything from pets to rentals. Reviewing these rules ensures they align with your lifestyle:

Pet Policies:

Some condos restrict the number, size, or type of pets allowed.

Rental Restrictions:

Many buildings have rules on short-term rentals or subletting.

Balcony and Barbecue Use:

Some buildings restrict the use of balconies for barbecuing or drying clothes.

Knowing these details upfront helps you avoid surprises later.

Deferred Maintenance and Building Age

Older buildings often come with deferred maintenance, such as worn-out elevators, leaking roofs, or aging plumbing. Reviewing engineering reports and depreciation studies can provide insight into the building’s physical condition.

Deferred maintenance often leads to higher repair costs and potential special assessments for owners.

Reserve Fund Study: The Building’s Financial and Physical Health

The reserve fund study is one of the most important tools to understand the financial and physical state of a condo building. This document details:

Planned repairs and replacements over the next 10+ years.

The current reserve fund balance and whether it’s adequate to cover these costs.

Cost estimates for major expenses like roof replacements, plumbing upgrades, or elevator repairs.

Why It’s Important:

A well-maintained building with a healthy reserve fund ensures predictable costs and fewer surprises for owners. Analyzing this study also provides a glimpse into the building’s physical health - is the board proactively maintaining the building, or are they deferring repairs to save money?

Special Assessments: Predictable or Avoidable?

Special assessments are often the result of underfunded reserves. Reviewing the reserve fund study can help you anticipate potential assessments by highlighting major upcoming expenses and how they’ll be funded.

For example, if the reserve fund is too low to cover a planned roof replacement, owners may be charged a special assessment to make up the difference.

Community Atmosphere

Condo living is about community. Reviewing meeting minutes can reveal recurring complaints about specific units or disputes among neighbors. If certain issues, like noise complaints or parking conflicts, remain unresolved, it could indicate deeper problems with building management or resident cooperation.

Simplify Your Condo Document Review with StrataReports

Reviewing lengthy condo documents can be overwhelming. StrataReports makes it easier with:

AI-Powered Analysis:

Quickly highlights financial details, upcoming assessments, and potential risks.

Clear Summaries:

Understand reserve fund health, legal issues, and maintenance records at a glance.

Interactive Assistance:

Our chatbot is always available to answer your questions.

Protect Your Investment

Thoroughly reviewing condo documents is crucial to making an informed decision. By analyzing financials, reserve fund studies, meeting minutes, and bylaws, you can avoid surprises and choose a condo that fits your lifestyle and budget.

Ready to simplify the process? Get started with StrataReports today.

Explore our sample condo and strata document review report to discover how we highlight the potential and concerns of properties, aiding both real estate professionals and buyers.