Protect Your Investment: How to Review Strata Documents in B.C.

If you're planning to buy a condo in British Columbia, reviewing strata documents is one of the most crucial steps to protect your investment. From understanding building finances to assessing maintenance practices, these documents provide a window into the health and management of the property you're about to call home.

In this guide, we’ll highlight the most important factors to consider when reviewing strata documents in B.C., helping you avoid financial pitfalls and make an informed decision.

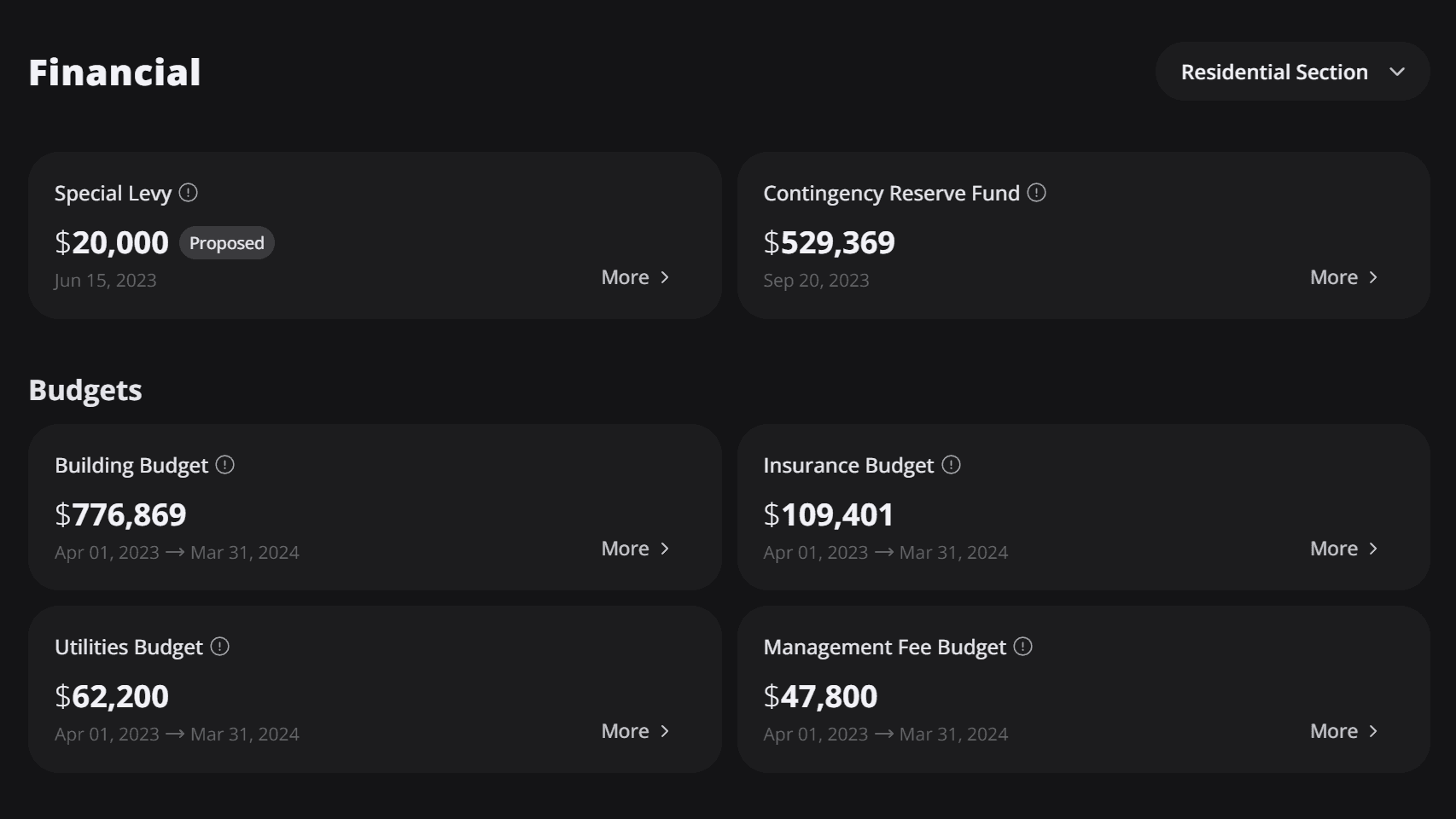

The Contingency Reserve Fund (CRF): Is It Prepared for the Future?

A strata’s Contingency Reserve Fund (CRF) is the financial safety net used for major repairs and replacements, such as re-roofing or elevator upgrades. B.C. laws mandate minimum contributions, but some strata corporations fail to keep the fund adequately stocked.

Why It Matters

An underfunded CRF can lead to steep special levies when unexpected repairs arise. For example, many older buildings in Vancouver have had to impose large levies to cover delayed infrastructure upgrades.

What to Look For

Current CRF balance and contribution history.

Upcoming projects listed in the depreciation report and whether the CRF can cover them.

Any plans to increase CRF contributions in the annual budget.

Special Levies: What Are You on the Hook For?

A special levy is an additional charge imposed on owners when the CRF doesn’t have enough to cover major expenses, such as plumbing repairs or building envelope upgrades.

Why It Matters

Special levies can range from a few hundred to tens of thousands of dollars. In many instances, condo owners in B.C. have faced sudden levies for unexpected repairs, catching them financially off guard.

What to Look For

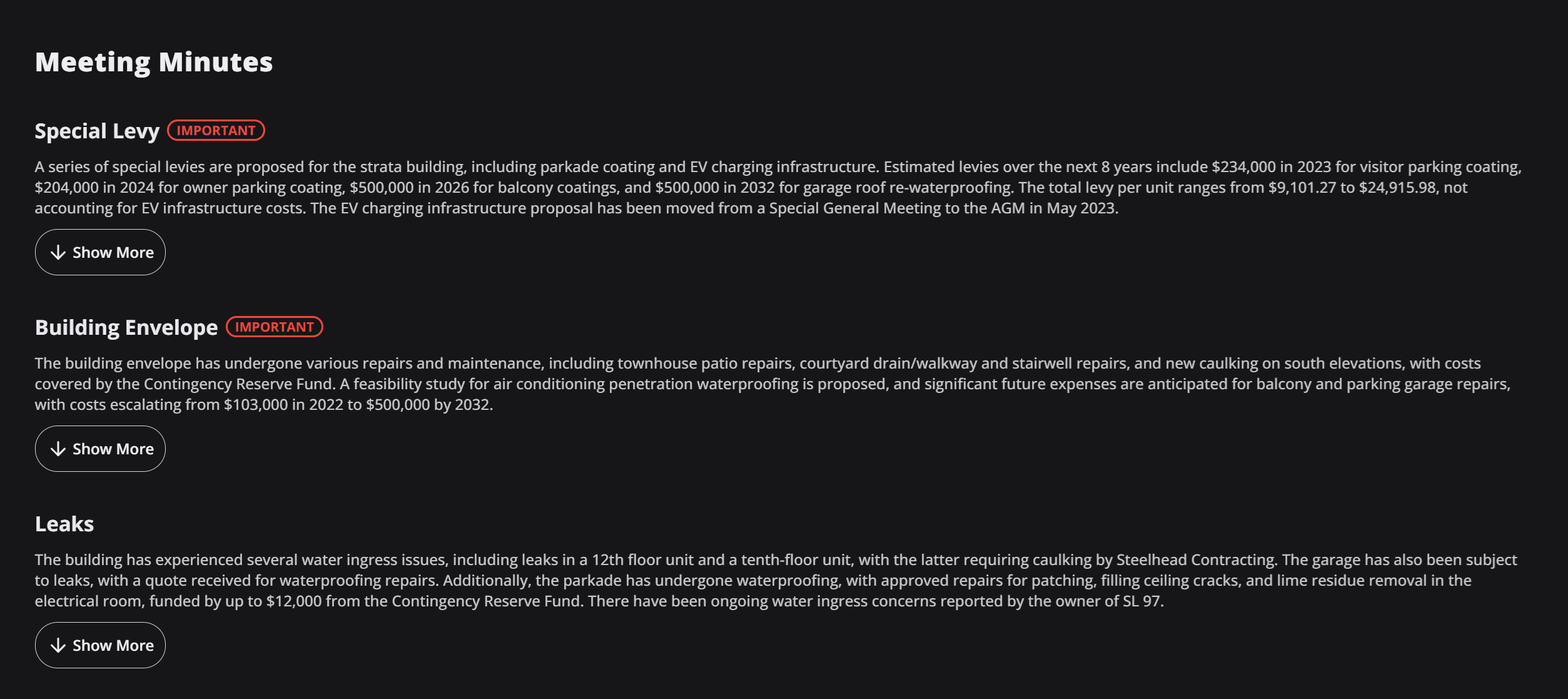

Any approved or proposed special levies in the meeting minutes.

Historical reliance on levies instead of planning ahead through the CRF.

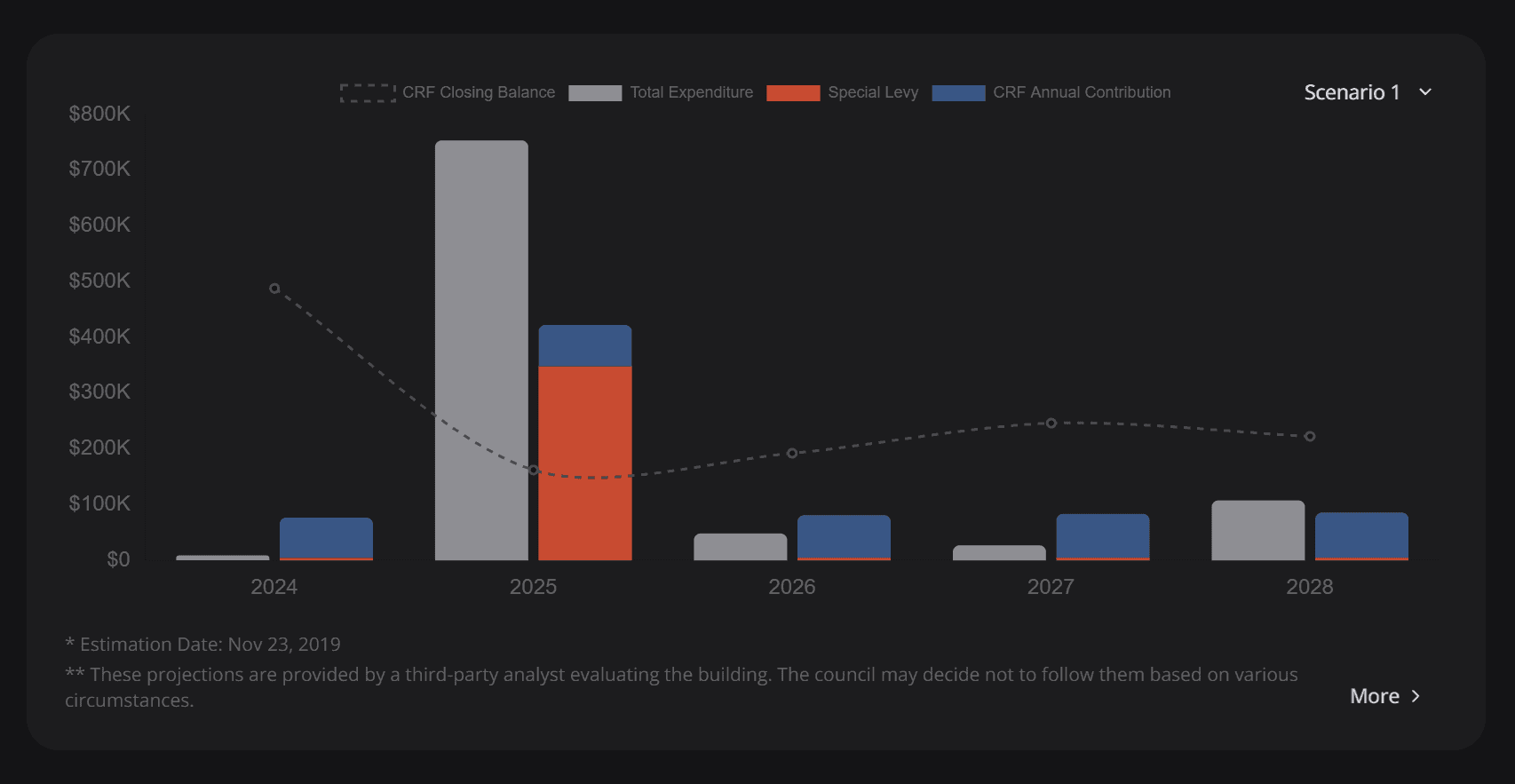

Projected Costs: How Reliable Are They?

Projected costs are estimates for future repairs and replacements, usually provided in the depreciation report. These projections help owners understand upcoming financial obligations and how they may impact strata fees or special levies.

Why It Matters

While projections provide valuable insights, they are based on current conditions and assumptions, which may change over time. For example, inflation, material shortages, or unforeseen issues like water ingress can drive costs higher than anticipated. Buildings with well-maintained CRFs and a history of accurate planning are better equipped to handle surprises.

What to Look For

The reliability of the depreciation report: Is it recent, or outdated by several years?

Whether the report includes detailed timelines and cost estimates for major repairs.

Strata council meeting minutes that discuss how projections are being managed or adjusted.

Strata Fees: A Closer Look at Monthly Costs

Strata fees are monthly payments made by owners to cover operating expenses, such as cleaning, insurance, and utilities.

Why It Matters

While strata fees are a normal part of condo ownership, rapidly increasing or unusually high fees can signal financial mismanagement or hidden issues. On the other hand, fees that seem artificially low might indicate deferred maintenance or inadequate CRF contributions.

What to Look For

A clear breakdown of where strata fees are allocated.

Any recent increases or planned fee hikes.

Comparisons to fees in similar buildings in the area.

Deferred Maintenance: Small Issues That Can Snowball

Deferred maintenance refers to repairs that have been delayed. Examples include old elevators needing modernization, cracked parkade surfaces, or deteriorating caulking.

Why It Matters

Delaying repairs often leads to more costly fixes down the road. For instance, neglected waterproofing can cause water ingress issues, damaging structural components and driving up repair costs.

What to Look For

Depreciation report details on maintenance projects and their status.

Comments in meeting minutes about unresolved repair issues.

Legal Disputes: Warning Signs of Trouble

Legal issues, such as lawsuits against contractors or disputes between owners and the strata council, are common in poorly managed buildings.

Why It Matters

Ongoing legal problems can drain resources, increase fees, and create a tense living environment. For example, unresolved lawsuits can make it harder to secure a mortgage or sell your unit.

What to Look For

Meeting minutes mentioning legal disputes.

Notes on ongoing claims or arbitration cases.

Insurance Gaps: Are You Protected?

Strata insurance should provide comprehensive coverage for the building, but rising premiums and deductibles in B.C. are a growing concern.

Why It Matters

Without adequate insurance, owners could face out-of-pocket expenses for repairs. High deductibles, especially for earthquake or water damage, can also leave owners vulnerable.

What to Look For

The building’s insurance policy, including deductible amounts.

Whether earthquake coverage is included (essential in Metro Vancouver).

Meeting Minutes: Transparency and Management Quality

Meeting minutes provide insights into how the strata operates and handles issues. They also reveal the overall tone of discussions and the council's responsiveness to owner concerns.

Why It Matters

Unorganized or vague meeting minutes can signal poor management. Frequent complaints about unresolved issues, such as noise or bylaw violations, can point to deeper problems.

What to Look For

Recurring complaints or unresolved issues.

Transparency in reporting finances and project updates.

Building Bylaws: Do They Fit Your Lifestyle?

Strata bylaws regulate everything from pets to renovations. Strict or outdated bylaws may limit your enjoyment of your property.

Why It Matters

For example, some buildings in B.C. enforce strict no-pet policies or prohibit short-term rentals, which could impact your lifestyle or investment plans.

What to Look For

Bylaws that align with your needs, such as pet or rental rules.

Flexibility for future renovations or changes.

Building History and Developer Reputation

The history of the building and its developer can provide clues about construction quality and long-term performance.

Why It Matters

Buildings from reputable developers tend to have fewer issues over time. Conversely, those with a history of construction defects may require costly repairs.

What to Look For

Records of past construction issues, such as water ingress or faulty plumbing.

Developer reviews and feedback from previous projects.

How StrataReports Can Help

Reviewing strata documents can be overwhelming, especially for first-time buyers. StrataReports simplifies the process by using AI to analyze financial statements, meeting minutes, and other key documents. We highlight potential red flags, giving you the insights you need to make a confident decision.

Final Thoughts

Buying a condo in British Columbia is an exciting step, but it comes with responsibilities. Taking the time to thoroughly review strata documents ensures you understand the financial and operational health of the building before you commit.

Ready to make your next move? Try StrataReports today for a fast, detailed analysis of your strata documents.

Explore our sample condo and strata document review report to discover how we highlight the potential and concerns of properties, aiding both real estate professionals and buyers.